Learn How to Protect Yourself Against Fraud

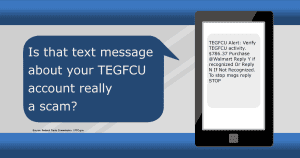

Fraudsters will use every method that is available to them to access personal information to scam people. Scammers often say there’s a problem with your account, or they question a purchase to lure people into their scheme. It’s important to know their tactics and tricks so you do not become a victim of fraud. Learn how to protect yourself.

One of the most important things to keep in mind is:

TEG Federal Credit Union will never contact members via phone, email, text message, or cell phone to request personal information such as account numbers, passwords, debit or credit card numbers, expiration dates, or personal identification numbers (PIN).

If you think you may have been a victim of fraud or to report unauthorized transactions on your account, please notify us immediately by calling 845.452.7323.

Free Security Tips to Monitor Your Money

Correct Your Contact Information

The Credit Union’s primary goal is the security of your personal information. One of the easiest ways to help keep your information and accounts secure and private is to confirm we always have your correct and current:

- Home Address

- Email Address

- Phone Number(s)

3 Ways to verify your contact information:

- Login to Online Banking

- Contact our Solution Center 845.452.7323

- Visit a branch

Be Your Account’s First Line of Defense

Valued members like you can stop thieves and scammers. Here’s how.

- Stay Alert: Always keep an eye on your accounts. Regularly checking your accounts in Digital Banking can help spot any suspicious activity early.

- Be Secure: Use strong, unique passwords for each account. Change them regularly to keep your information safe. Consider using Multi-factor Authentication.

- Think Twice: Be cautious about sharing personal information. If a request seems suspicious, it probably is.

Your security is our priority

Together, we can keep your accounts and identity safe.

As a general guideline, be highly suspicious anytime you are asked to provide personal information over the phone, text, or email. If you have given out your personal information on an unsolicited phone call or text message, please call our Solution Center at 845.452.7323.

Easy, Free Tools to Help You Detect or Prevent Fraud

We get it. You’re on the move. That’s why we’ve got savvy tools ready to help you keep an eye on your money and shield you from fraud. Here’s a quick peek at our free tools to help you track your finances around the clock. Stay informed, stay secure – that’s our promise to you.

Monitor Your Credit Score

Unexpected changes to your credit score can be an early warning sign of identity theft. We think it’s so important to know your credit score that we put SavvyMoney, our credit monitoring tool, right into our Mobile Banking App and Online Banking for easy access.

Use Your Digital Wallet

Encrypt your TEGFCU Credit Cards and Debit Cards with the digital payment method of your choice. It’s a simple, easy way to protect your payment info and keep your accounts safe under multiple layers of security. If you own a smartphone, you can access a digital wallet, speeding you through checkouts while keeping your payment information secure.

Set Real-Time Alerts

Keep tabs on your accounts with real-time email or text alerts. Log in to digital banking to choose the alerts that work for you. Schedule daily balance alerts, customize debit & credit card use alerts, set loan due alerts, and a lot more!

Keep Your Personal Accounts Secure!

Phishing Scams

Learn how you can protect yourself from scammers using email or text message to try and trick you.

Online Security

Learn steps you can take to protect your computer and your information.

Your Privacy

Learn how you can protect your privacy online and in mobile apps.

Identity Theft

Discover things you can do to reduce your risk of identity theft.

Read the latest Security Tips!

Here’s What To Do

Never Click

Never click a link or open an email from senders you don’t recognize.

Read

Read each email and text carefully. Is everything spelled correctly? Is it logical? Were you expecting it?

Remember

Remember companies won’t text you links to take a survey for money.