Closing costs typically are about 3-5% of your new home’s purchase price. This amount may vary, however, based on your home’s location, cost and other factors. Lenders are required to provide a Loan Estimate, which includes information about closing costs, within three days after you apply for a loan. Remember—this is just an estimate.

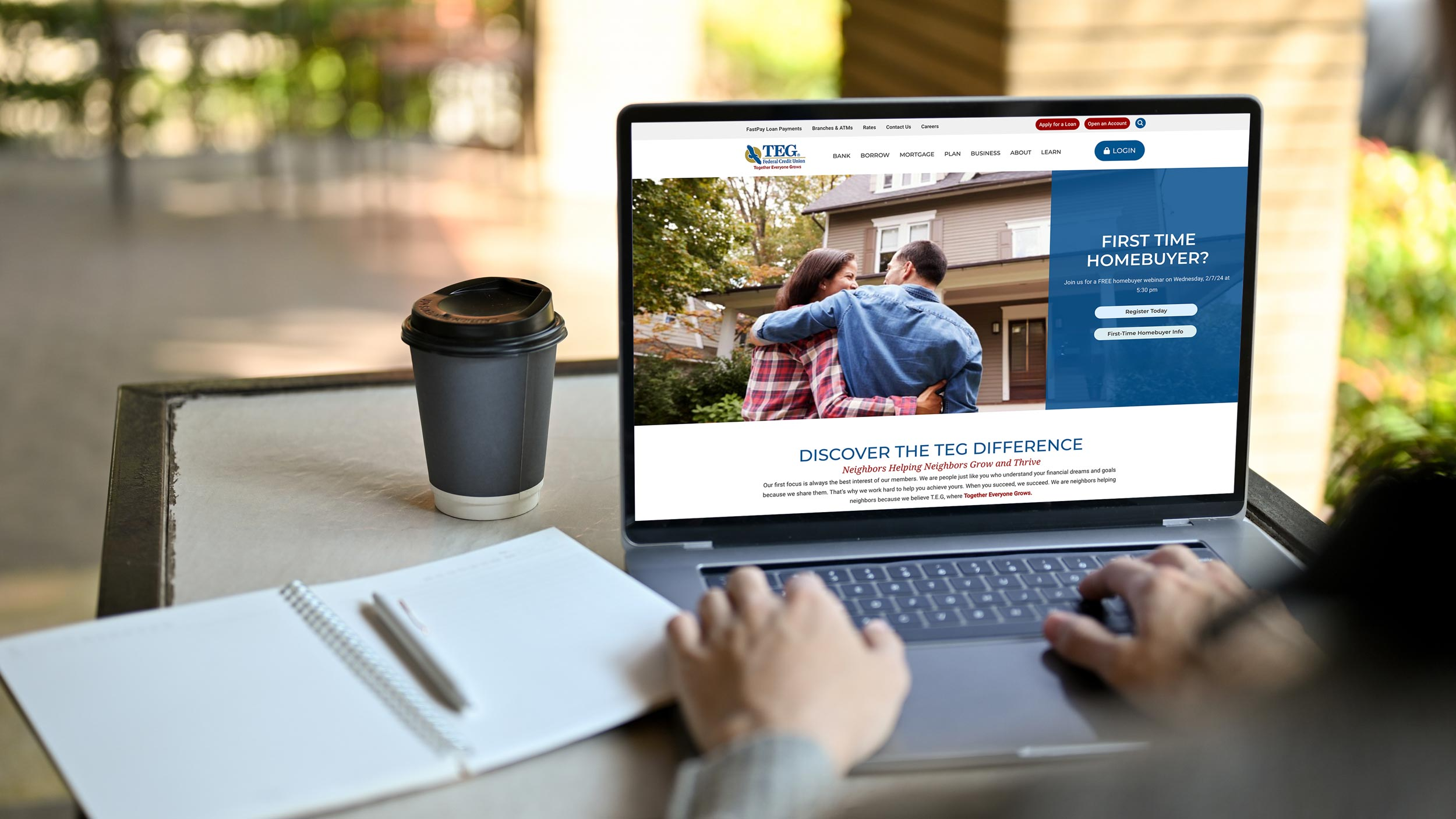

Welcome to our new TEG Federal Credit Union website. We’re delighted to unveil our revamped website, which showcases many enhanced features to make your experience of TEGFCU.com that much better.

You will find that the streamlined design elements are fresh with vibrant colors, pleasing to the eye, and not overwhelming or busy. The structure is laid out in a user-friendly way so you can quickly find what you’re looking for with ease. Our nimble website is optimized to work well on all device sizes.

The new super menus and intuitive navigation make it quick and easy to access the information you use most, as well as seamless access to a variety of convenient services. We hope you will find the top-quality digital content helpful in making informed decisions with interesting articles, rates, and special offers. Be sure to check in frequently.

Be assured that your digital banking experience will remain just as seamless. Whether you log in at home or on the go, you can conveniently and securely access your accounts anywhere, anytime.

For a more convenient banking experience, download our user-friendly mobile app that allows you to manage your finances on the go even faster. It is available on Android/Google Play Store & iOS/Apple App Store.

At TEGFCU, we believe in putting people first and investing in our members. Our staff works hard to give you an exceptional experience. We constantly look for innovative ways to grow and make a positive impact. Since 1969, we’ve been by your side, evolving alongside your ever-changing financial needs and helping you reach your financial goals. We want to empower our members to achieve financial success.

This commitment to growth applies to our website, too. That means ensuring the same level of service you expect no matter how you reach us. It was built with an increased focus on financial wellness, education, and community to reflect our mission to improve the lives of everyone who interacts with us. As you explore our new site, you’ll find information about all our products and services, up-to-date information about loan rates, and other important topics. We are neighbors helping neighbors because we believe in T.E.G, where Together, Everyone Grows.

We’re excited to share our new look and website with you, and we hope you love it as much as we do! Feel free to send your feedback to Marketing@TEGFCU.com.