Credit Score Breakdown – Your path to good credit

Your financial wellness is important to us. Does Your credit score seem like a mystery? Think of your credit score as a snapshot of your credit history. Knowledge is power, and understanding your credit score helps you improve it. That’s why TEG Federal Credit Union offers FREE credit score education and resources.

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness—a measure of how likely you are to repay loans and manage credit responsibly. Also known as your FICO score, this three-digit number, typically 300 to 850, is calculated based on your credit history and financial behavior and is meant to give creditors a fair, accurate, and quick way to evaluate RISK.

Why is a Good Credit Score Important?

A good credit score is crucial for financial health and can open doors to numerous financial opportunities. At TEGFCU, we want to guide you on what information goes into your credit score, what your rating means, what opportunities might be available, and at what cost, and, if necessary, how to improve your credit score.

Build Your Credit

Raise your score with our trustworthy personal counseling from TEG

What is a FICO?

A summary of your credit report info is represented as a three-digit number. Based on mathematical calculations, creditors are provided with a fair, accurate, and quick way to evaluate RISK.

Range of Credit Scores

A: Excellent (680-850)

Exceptional credit management

B: Very Good (650-679)

Strong financial health

C: Good (620-649)

Average risk to lenders

D: Fair (600-619)

Higher risk; may face some credit limitations

E: Poor (300-599)

Significant risk; difficulty obtaining credit

Financial Benefits

- Loan Approvals: Lenders use your credit score to determine your eligibility for loans, including mortgages, auto loans, and personal loans.

- Interest Rates: A higher credit score often results in lower interest rates, which can save you money over the life of a loan.

- Credit Card Offers: A good credit score makes you more likely to qualify for credit cards with better rewards and lower fees.

- Everyday Impact: Landlords, employers, Insurance companies, and utility/phone companies may check your score and credit history. It could make a difference in your application process or affect your costs.

Understanding your Credit Score

What Makes Up Your Credit Score?

- 35% Payment History (do you pay on time)

- 30% Capacity (debt owed vs. available credit)

- 15% Length of Credit (length of new credit and total history)

- 10% New Credit (new credit and # of recent inquiries)

- 10% Credit Mix (percent of revolving vs. installment)

Take Steps to Boost Your Score

- Continue to make payments on time to build a solid credit history.

- Diversifying your credit with various credit types can positively impact your score. Move revolving into installment debt.

- Keep credit card balances as low as possible and limits as high as possible

- Pay down existing debt and avoid accumulating high balances.

Recent Payment History Has More Influence

- 40% weight = current to past 12 months

- 30% weight = 13-24 months

- 20% weight = 25-36 months

- 10% weight = 37+ months

Negative credit will stay on your credit report for 7 or 10 years, but the negative impact fades quickly out of the score.

Recognize Actions That Hurt Your Score

- Missing payments – pay on time!

- Maxing out Credit cards – Keep your usage below 30% of your available credit.

- Shopping for credit excessively – Too many inquiries can lower your score.

- Opening numerous accounts in a short period of time

- Borrowing from finance companies (sub-prime lenders/store cards)

- Closing credit cards – Lengthen your credit history and keep capacity by keeping older accounts active.

Get Savvy With Your Money!

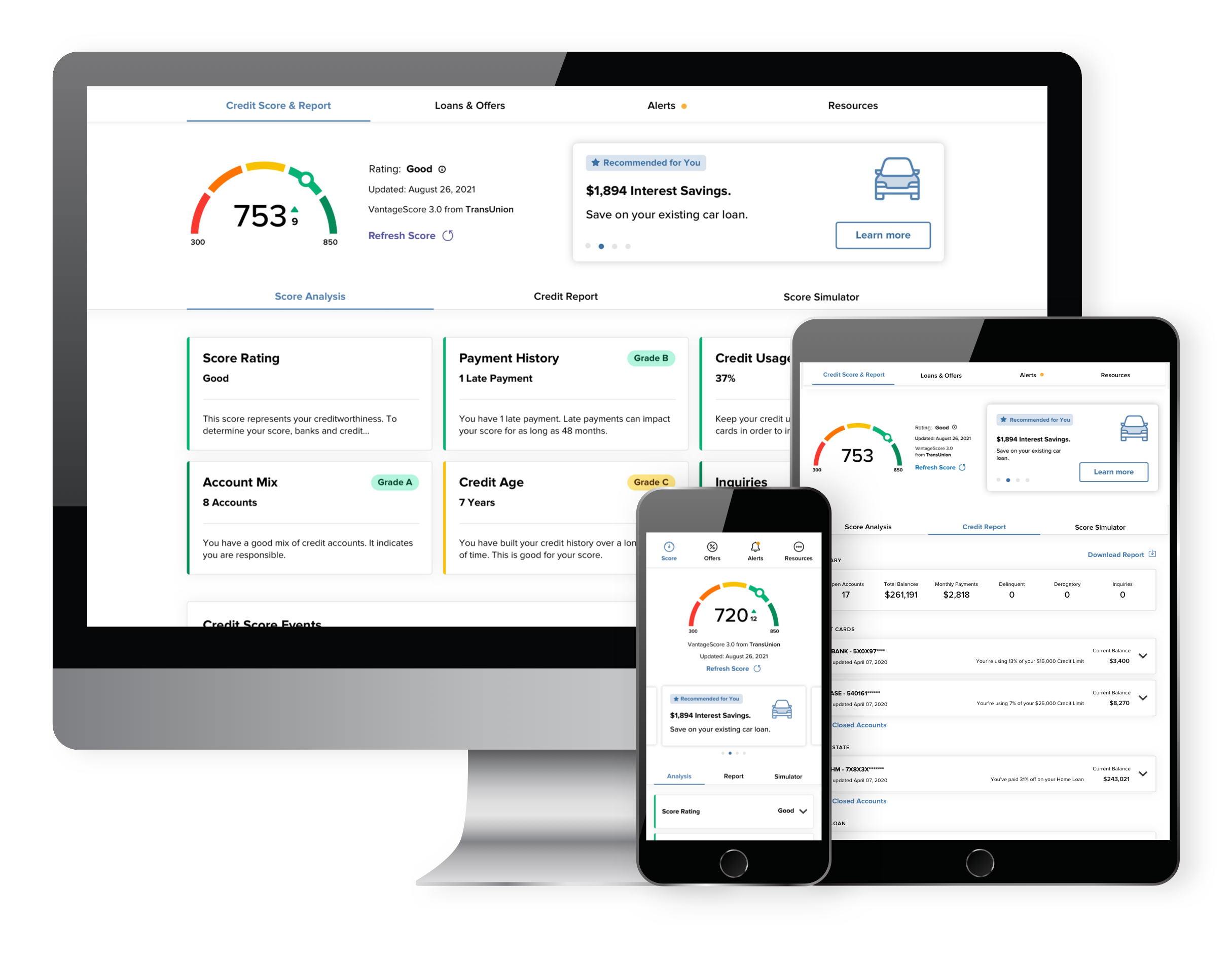

SavvyMoney is a comprehensive credit score program in our Digital Banking Solution that instantly provides you with free credit score analysis, your full credit report, monitoring, credit alerts, and personalized offers — all in one dashboard.

Explore Resources