There comes a time when everyone needs to start prioritizing their credit score. Whether you’re applying for a credit card or a loan, your credit score impacts your ability to access these products. There are five major factors to consider, often referred to as the 5 C’s of credit, when you’re improving your credit score. Character, Capacity, Capital, Collateral and Conditions are concepts you need to familiarize yourself with, but let’s focus on the second C, Capacity.

There are many strategies to improve your credit score.

Let’s dive into how capacity helps.

What is Credit Capacity?

Credit capacity refers to the relationship between an individual’s credit card and lines of credit, explicitly focusing on balance versus limits. Lines of credit may include cash lines, overdraft lines and HEQ lines of credit. An example of the relationship between limits and balances can be seen through this theoretical scenario: If you have $10k in limits with $4k in balances, your capacity would be 60 percent, or 40 percent utilized.

It’s imperative to understand balance versus limits in relation to credit capacity. Your limit is how much credit is available to you as the borrower, whereas balance refers to how much you currently owe. Because of this, balance and limits play a significant role in your credit score. The recommended credit card usage should be ideally below 30 percent.

Income is one of the most prominent factors of credit capacity, as it determines your credit limit. This ties into lender exposure risk, which according to investopedia.com, can be defined as “Exposure is the maximum potential loss a lender may incur if the borrower defaults. It’s a risk measurement technique to assess the position of the lender, the characteristics of the borrower, and the possibility of loss.” Analyzing the lender exposure risk and your income will make it easier to obtain the loan you want. And everything comes down to your ability to repay debt. If it doesn’t seem that you’ll be able to repay, it’ll make it harder for you to get the loan or the credit card you’re looking for.

The same can be said for your credit score. If you’re not paying your credit card on time or have a negative balance, your credit score is bound to decrease. You may be wondering, “how long does it take to improve credit score?” The answer to this varies based on your credit usage.

What’s a Good DTI Ratio?

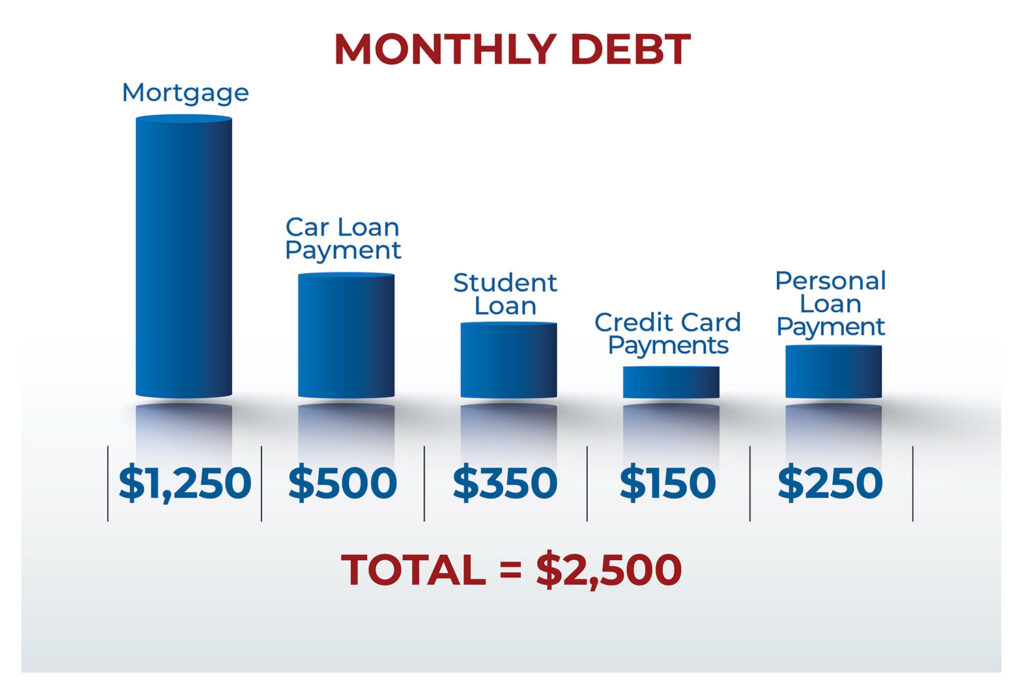

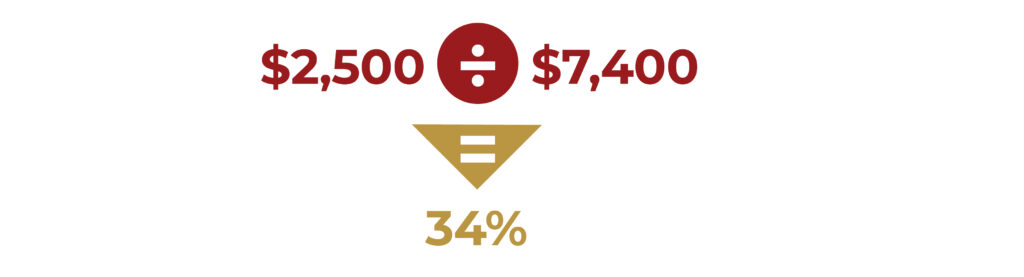

The DTI ratio is an easy calculation made by lenders. If you’d like to assess your DTI for yourself, add up your monthly debts and divide by your income. The DTI ratio is best reflected as a percentage. Lenders view 40-44 percent as a good debt to income ratio, and under 40 percent is considered excellent.

You can use a debt-to-income ratio calculator, or follow these helpful steps.

Here’s an example to see how easy it is to calculate the DTI ratio

Perhaps your DTI ratio exceeds the 40 percent mark, so how do you improve your credit score and lower your DTI? There are several ways to lower your DTI. One of the more obvious solutions is to increase your income, but because not everyone is in the position to do so, there are easier ways to do this. Contributing more to paying a debt can help lower your debt overall. With this being said, you should also abstain from taking on more debt, and avoid making large investments for the time being.

WAYS TO IMPROVE YOUR CREDIT CAPACITY

Increase your Income

Pay Off your Debts

Avoid Unecessary Spending

Consolidate Your Debts

A DTI greater than 45 percent is considered a cautious zone. And DTI’s over 50 percent are viewed as high risk for the potential lender. Because DTI is only calculating your gross income, the ratio doesn’t factor in any additional expenses that aren’t on your credit report. These expenses can include a mobile phone bill, car insurance, cable bill, and the taxes taken from your pay.

“The most rewarding part of working in my role at TEGFCU is helping members realize their credit score potential. Showing them how to understand their score and develop a plan to increase their score never gets boring. Celebrating when the goal is achieved is very gratifying for all of us involved.”

Shelby Watson, Branch Manager.

Contact a TEG Financial Expert

to Discuss Your DTI and Options today!

How Can TEG Help You?

TEG can help by doing a Credit Bureau Review. Sitting down with any of our trained credit experts and reviewing your credit report for ways to improve and understand your credit score can help you save money and grow your score in as little as 90 days.

Visit your local branch to receive this service from TEG’s trained specialists.